« The Just Wage-- A Christian Approach to the Market | Main | The Republican Party: More Rockefeller than Goldwater; Neumayr's Article »

September 19, 2004

The Consumer Surplus Argument for Patent Monopolies

UPDATE, Sept. 30: I see that Farrell and Shapiro mention the "profit-stealing" I discuss below, as a "well-known principle", citing Mankiw and Whinston, 1985, RJE, on entry into oligopolies.

I was just skimming Mark Lemley's working paper, "Property, Intellectual Property, and Free Riding", on the recommendations of ProfessorsSolum and Volokh. On page 39 it cites Farrell and Shapiro's 2004 working paper, "Intellectual Property, Competition and Information Technology" on the point that a patent monopoly does not reward the inventor enough. I haven't read their paper, though I know I ought to (especially since Farrell was on my thesis committee back in 1984), but I thought about the idea, and I'll write these notes for myself, weblog readers, and those three authors....

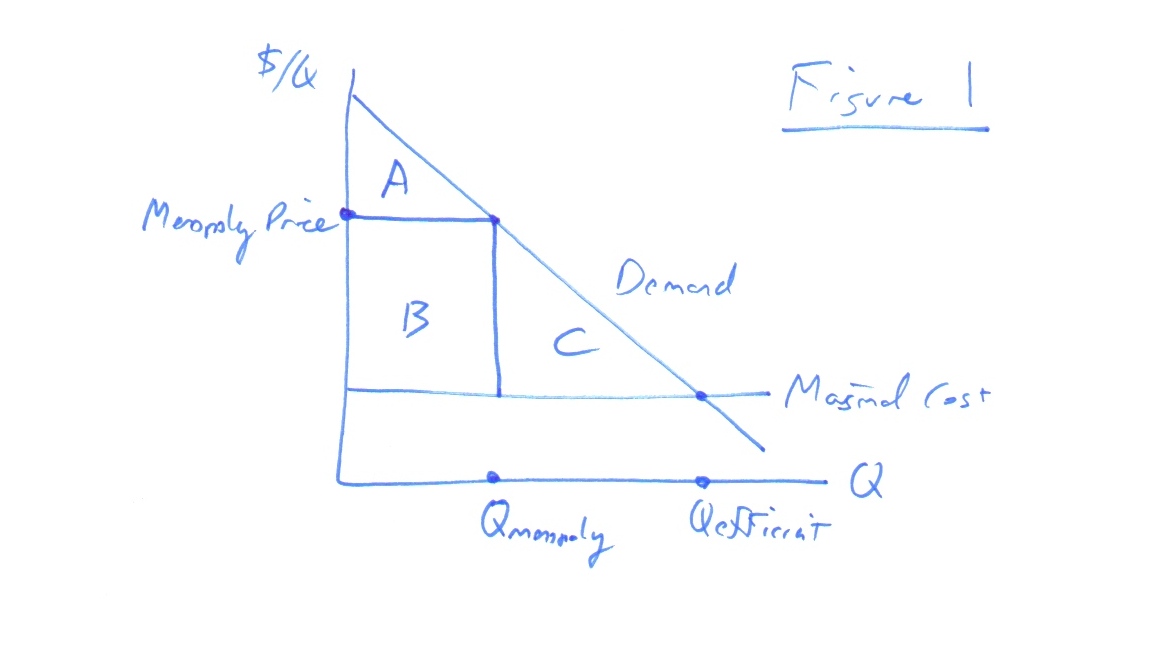

... The problem is illustrated in Figure 1. An inventor is thinking of spending amount X to invent something with the demand curve and marginal cost curve illustrated. If he did and there was no patent, then competition would force the price down to marginal cost, and although consumer surplus would be maximized, at A+B+C, there would be zero producer surplus and his net payoff would be -X. So he wouldn't undertake the research.

A patent would help. Then he would have a monopoly, and charge a price above marginal cost, earning producer surplus B. But if B is less than X, he still won't undertake the invention. Since it is possible that X is bigger than B but smaller than B+A (not mention B+A+C), patents won't yield enough profits to induce some efficient inventions.

All that is quite correct. To get the correct incentives, we need to give the inventor amount A+B+C and get the quantity of output to increase to the efficient level in Figure 1. A government bounty system might do that, some people have suggested, or government funding of research.

What makes me uncomfortable about the analysis of Figure 1, though, is that it takes the demand curve as given, and is partial equilibrium analysis. Someone must have done a general equilibrium analysis of this-- looking at an economy with two goods and finding out the incentive to invent a third good-- but I don't know of it.

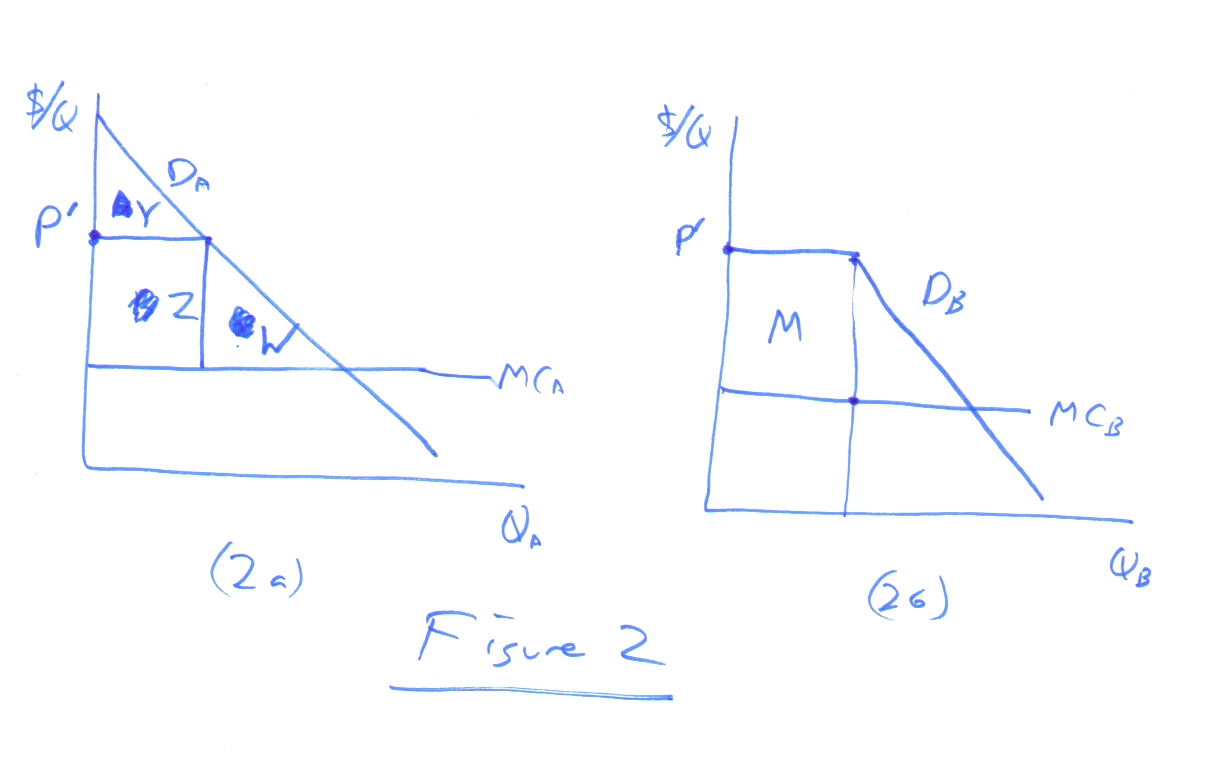

I won't do a general equilibrium analysis here, but I'll do a bit broader partial equilibrium analysis. Figure 2b looks at the same inventor who can spend X to create a new good, good B. Good B, however, is a perfect substitute for the existing good A, which has already been patented by another inventor who is charging P' for it and earning producer surplus of Z. Suppose our B-inventor pays X and gets his patent, and that the A-inventor continues to charge P'. The demand curve facing good B will then have the appearance of Figure 2b-- flat at a price of P' (since Good A is a perfect substitute) and then downward sloping at lower prices. Our B-inventor will choose a price slightly below P' and have a producer surplus of M, which, let us assume is greater than X. But consumer surplus will have risen negligibly from before the invention, and the A-inventor's producer surplus will have fallen by Z, which is just about the same size as M. Overall, social surplus will have fallen by about X-- the new invention is a social waste, invented only to transfer surplus from the A-inventor to the B-inventor. So patents give too much incentive for invention.

My analysis is incomplete, because the A-inventor will not keep charging P' when he is undercut-- the two products will settle at some lower, duopoly price, so surplus will in fact rise to the extent that output rises. But that would not change the basic conclusion: that if some of the profit from an invention is taken from reduced profits from another invention, patents can be a bad thing.

In economics one can always contrive a second-best argument like this, but this one has considerable plausibility. We are, after all, talking about an industry where one invention can occur, which makes previous patented inventions a reasonable assumption. Note that it is also an argument for short patent life, because if inventions occur with enough spacing, we won't have one monopoly stealing surplus from a previous one.

Overall, though, to return to Lemley's theme, what Figure 2 should lead us to conclude is not that patents are bad, but that we don't have as much reason to worry about inventors not getting sufficient reward as we might think after looking at Figure 1. There are other reasons along these lines too, such as Patent Races, in which competition to get the patent dissipates its value.

Posted by erasmuse at September 19, 2004 05:18 PM

Trackback Pings

TrackBack URL for this entry: http://www.rasmusen.org/mt-new/mt-tb.cgi/210