Seminar Notes

Andrew Lo, Medical Innovation Finance, Markus Brunnemeier Princeton Workshop, February 4, 2021

Andy: I actually invested in something like this. (digressive story, maybe don't read till tomorrow). I sued Citigroup as a tax whistleblower for unpaid New York State corporation income tax. I invested perhaps $200,000 of time and money. Probability of success was low, perhaps 5%, for me and my law firm that would get 40%. It would take about 5 years if successful. The prize, however, was $300 million-- $180 million for me. It was still hard to explain to my wife. See http://www.rasmusen.org/citigroup/.

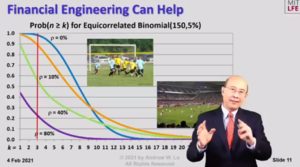

My story is an example of a more general example--litigation finance is really important, because a lot of lawsuits are longshots, much like medicine.

From Me to All Panelists: 01:31 PM

"Financial risk": marvellous idea. Does this also explain why small firms have higher betas? Could it explain the "small firm effect"? Is there a "biotech effect" if you look at how well CAPM explains biotech returns?

Could this all trace back to bankruptcy risk? (not just lower profits, but bankruptcy costs?) That rises nonlinearly in recessions, for small firms especially, and is then correlated across small firms.

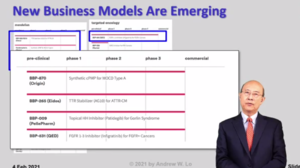

Should we expect that one big firm would specialize in orphan diseases? Or should it be that little firms do it, and investors buy stock in all of them? Again, bankrtupcy costs-- so the one big firm is better.

Or, option (3): all big firms each do one orphan disease. That should be just as good as one firm specializing in them, from a financail point of view at least . (Maybe for regulatory and political ecnomy expertise, specialization is better.)

Standing up to give a talk is much better than sitting down. It is also much better to have the setup where you look like you're standing in front of the Screen-Share than when you disappear and all the audience sees is the diagram or equations. Moreover, when both are there at once, you can point to a particular point on the screen, if you can see yourself too so you can see that you are pointing properly.