Graveyard Bonds

I just had an idea I'll call "the graveyard bond". It's probably not new, being pretty obvious, but it's something I think I'll actually use tonight. And it has tax advantages that are potentially of great interest on Wall Street; if nobody's using graveyard bonds, I'd be curious as to why not. The idea is to defer interest income taxation. How, I'll get to after my graveyard story.

My church is setting up a graveyard. To do so, they've set up a separate entity, with its own accounts. Non-church graveyards must, by law, set aside a certain amount of money for perpetual maintenance. Church ones in Indiana don't, but as a matter of good financial stewardship, our church wants to follow the regulations voluntarily. Let's suppose the amount is $100,000, to be concrete: the cemetery fund must always have $100,000 in its account, so it can use the income from that capital for cutting the grass and so forth.

The hope is that the graveyard will be self-financing, or perhaps even profitable eventually. It looks like a good business project to me. The church, however, is short of capital (the church building itself has had its extension at a halt for a couple of years because of lack of funds to finish the interior). Thus, I was asked if I'd be willing to contribute some capital--- say, $20,000---to be repaid with interest once the graveyard had the cash flow to do so.

I'm willing, and I think it is not only a good project spiritually, but financially. I probably won't ask for interest, since I donate to the church anyway and it just complicated things to earn income from the church, pay it back as a donation, and take a deduction to cancel out the income for tax purposes. But I was thinking in the car about how I'd want to arrange it if

I just had an idea I'll call "the graveyard bond". It's probably not new, being pretty obvious, but it's something I think I'll actually use tonight. And it has tax advantages that are potentially of great interest on Wall Street; if nobody's using graveyard bonds, I'd be curious as to why not. The idea is to defer interest income taxation. How, I'll get to after my graveyard story.

My church is setting up a graveyard. To do so, they've set up a separate entity, with its own accounts. Non-church graveyards must, by law, set aside a certain amount of money for perpetual maintenance. Church ones in Indiana don't, but as a matter of good financial stewardship, our church wants to follow the regulations voluntarily.

The hope is that the graveyard will be self-financing, or perhaps even profitable eventually. It looks like a good business project to me. The church, however, is short of capital (the church building itself has had its extension at a halt for a couple of years because of lack of funds to finish the interior). Thus, I was asked if I'd be willing to contribute some capital--- say, $20,000---to be repaid with interest once the graveyard had the cash flow to do so.

I'm willing, and I think it is not only a good project spiritually, but financially. I probably won't ask for interest, since I donate to the church anyway and it just complicated things to earn income from the church, pay it back as a donation, and take a deduction to cancel out the income for tax purposes. But I was thinking in the car about how I'd want to arrange it if I wanted to keep the interest.

I hate fiddly little things on my taxes, so I don't like getting monthly interest payments, or even annual ones. I'd rather get my interest in one big balloon payment at the end, compounded appropriately. That also has the advantage of deferring taxes, because then the tax on ten years' interest would be paid at the end of the tenth year, and not at nine earlier periods.

But actually, it wouldn't work to just ask for my interest to all be paid out at the tenth year. The Internal Revenue Service long ago noticed that this would defer taxes. Thus, the rule is that even if the interest is not paid out until the tenth year, taxes on its annual value must be paid annually. Thus, if a 10-year bond is $10,000 and the interest rate is 5%, to be paid out all at the end so the bondholder gets his $10,000 back plus $500*10 = $5,000 interest at the end of ten years, the bondholder must pay taxes on $500 of income each of the ten years anyway, rather than on $5,000 at the end. This actually makes economic and legal sense, because the bondholder really *is* earning $500 each year; he's just letting the graveyard hold onto it for him. For taxes, what counts is the point in time at which somebody legally owes you money, not the time when he actually pays you.

These are called "zero-coupon" bonds, because you don't clip a coupon off each year and turn it in to collect your interest as in the old days, or even just have them mail you a check each as is done now. Instead, a company might issue a bond promising to pay the holder $10,000 in 20 years, and people would buy the bond for $6,000 today, which amounts to a lump sum interest payment of $4,000 at the end.

Note that I don't even get the advantage of simpler accounting if I buy a zero-coupon bond from the church, because I still have to keep track of the implicit interest each year and report that the IRS, as does the church on their end with the 1099s.

So what can I do? Use a graveyard bond. This bond would be very similar to a zero-coupon bond, but would differ in one crucial respect. I would give $20,000 to the church today, and the church would promise to give me $30,000 in ten years--- but the promise would be contingent on the graveyard's profitability. If the graveyard didn't have $100,000 in ten years, it wouldn't have to pay me either interest or principle. The bond *would* require, however, that the church could not take any income from the graveyard for the church's general fund until it had paid off the graveyard bonds.

The graveyard bond is now a form of equity. In practice, we wouldn't call it a "bond", because that would imply it was a debt instrument, and taxable as debt, but it's not really a debt instrument. It's not, because its return depends on profit. It is like having equity with a dividend fixed in amount and time, but which, as a dividend, does not entitle the holder to go to court for collection. The holder cannot seize the delinquent borrower's assets or thrown him into bankruptcy. All he can do is prevent the delinquent from taking money out of the borrowing entity.

This is very similar to Preferred Stock. Preferred stock pays a fixed dividend each year, except the borrower is free to not pay in a given year, so long as he doesn't pay any dividends on ordinary stock. The unpaid dividends pile up, and the borrower must pay off all the old preferred stock dividends before he pays any ordinary stock dividends.

That's the idea. Other details are less important. The graveyard bond would have lower priority in bankruptcy than regular bonds or loans or trade debt, but higher priority than the stock (or the church, in my example). Also, I'd write it up as a non-negotiable contract rather than a negotiable instrument--- that is, it would be the church's promise to pay Eric Rasmusen, so I couldn't resell it to a stranger like I could with a bond.

Now let's return to the tax angle. Since this is equity now, I don't have to pay taxes on annual income, just on my share of the profits, if the graveyard is making profits after ten years. But it is otherwise very similar to a zero-coupon bond, and to bonds generally. Thus, if a company with assets of $900 million wants to borrow $50 million for thirty years on the bond market, maybe it should issue graveyard bonds instead. The bondholders will delay having to pay taxes for thirty years instead of each year during that interval. And a lot of bookkeeping could be avoided.

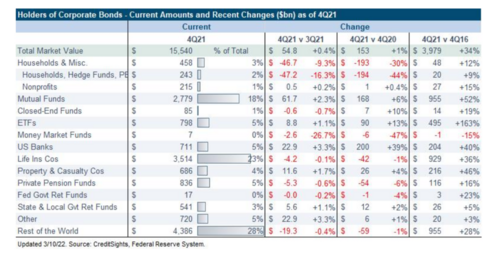

It could be that taxes on bonds are unimportant. Who holds them? Mostly foreigners, life insurance companies, and pension funds, as you can see on the table I found at Marketwatch.com. But it looks to me as if there are enough owners with ordinary tax treatment (e.g., not a nonprofit or life insurance company) for this to be relevant.